This week, I struggled to put pen to paper. Everything seemed uninspiring. On Thursday morning, I remembered an old tweet from a younger and wiser Bear and scrapped my plans. Instead, I will follow my own advice and just state clearly what I believe.

I don’t know what will happen in the market. No one does.

You can make predictions using data, analysis, and interpretation, but you will never know for sure. Instead, you must decide what you believe.

I believe the US stock market will fall further.

Valuation

Valuation is a poor indicator for stock price performance in the short term. In the long term it provides the mooring for the market.

The two basic components of valuation are how much money companies make (earnings) and how much people are willing to pay for those earnings (multiple). The pandemic stock boom was fueled by both record corporate earnings and expanding multiples. Today, both of those factors are reversing.

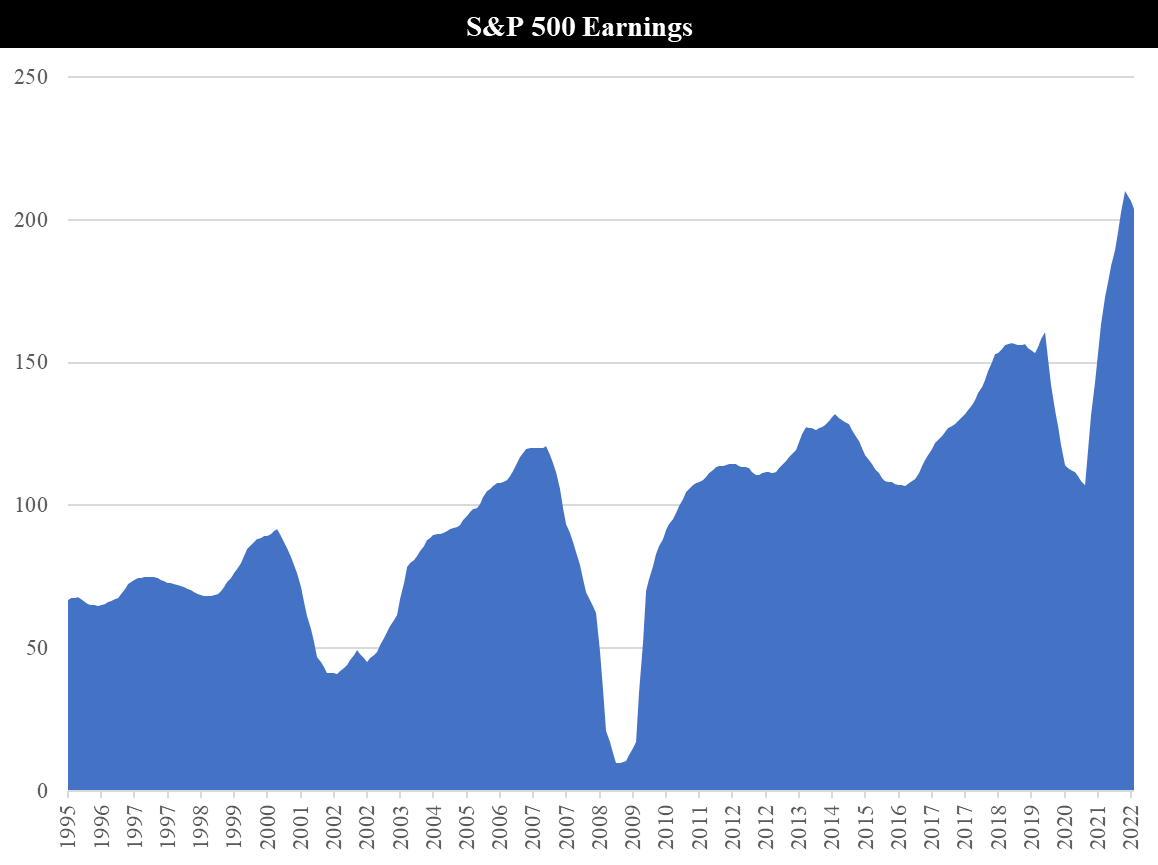

While corporate earnings have reliably grown over the decades, they are surprisingly variable from year to year and highly sensitive to economic conditions. Even mild recessions, such as 2000-2002, resulted in a 55% decline1 in S&P 500 earnings from peak to trough despite real GDP growing over the period. Severe recessions, like 2008 nearly wiped out earnings entirely.

S&P’s monthly reported data shows that earnings peaked in December 2021 at 210.3 and had slipped to 203.9 by March 2022 (the most recent reported date). While corporations benefitted from the stimulus of the past two years, leading to record margins, they now must contend with the lagged effect of inflation hitting their cost structures at the same time that the Fed attacks demand.

Earnings compression can already be seen even in the invincible mega-tech stocks that make up an outsize portion of the total market. Apple, Microsoft, and Google have seen last twelve months (LTM) earnings peak or begin to decline (though still remain much higher than pre-pandemic). Cost pressures at Amazon have already destroyed all of the earnings growth of the pandemic; LTM earnings per share are lower than they were in 20192. Earnings pressure will be far worse for weaker or cyclical companies.

Consensus estimates expect earnings to grow to over 240 in 2023. Even a mild recession will ensure that actual earnings significantly miss those expectations.

Meanwhile, multiples peaked last year and have been declining but remain elevated relative to historical averages3. The market’s multiple depends on a number of factors including interest rates, future earnings projections, and sentiment.

Last year, interest rates were at zero, earnings were skyrocketing, and sentiment was euphoric. Today, interest rates are reaching their highest levels in 14 years4, earnings are under pressure, and sentiment has soured dramatically.

Sentiment

While multiples and earnings provide a mathematic framework for valuation, they ignore the vitally important human dynamics5.

While bubbly signs pre-dated the pandemic, COVID sent these forces into overdrive. The March 2020 stock crash led to an influx of new traders and interest in the market. Those who took the gamble to buy low were rewarded. By November 2020, with news of effective vaccines and the market reaching new all-time highs, sentiment transformed from optimistic to euphoric.

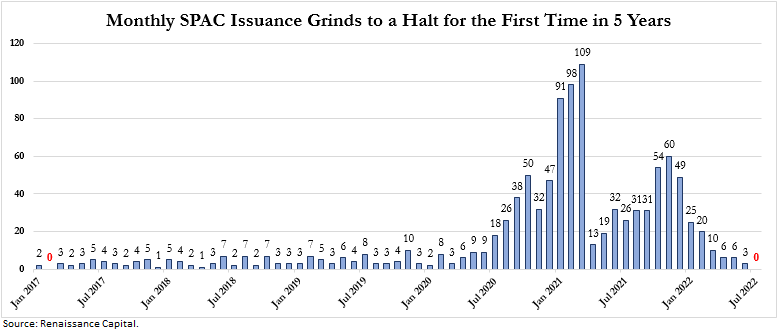

Its hard to pick a single example of the irrational exuberance of the COVID bubble. IPOs began doubling on their debut. SPACs (blank check companies) went from an obscure structure to dominating IPO markets. Meme-stocks meme’d. Celebrated short-sellers quit the practice and began publishing long-only research. Ethereum increased tenfold in six months. Tesla eclipsed a trillion-dollar valuation, making Elon Musk the richest person in the world. URLs to JPEGs were sold for millions of dollars. The message boards of the dot-com era were replaced with Discourse, Twitter, and Wall Street Bets.

Anything and everything were soaring. Fear of missing out was palpable - an entire asset class’s motto was “have fun staying poor”.

The key to these speculative investments is their social spread. More people entering the market drives the price up which attracts more people, and so on - a positive reinforcement cycle.

But if 2021 was a party, then 2022 is the hangover.

Over the past year, many of the pandemic high-flyers have been crushed - losing a large majority of their value. SPACs, which raised over $200 billion in 2021, have grinded to a halt. Crypto collapsed and HODL’ers hold bags.

It may be tempting to think that NFTs are not representative of the US stock market, but the fervor in these alt-assets coursed through stocks as well. It is impossible to segregate sentiment.

Today, sentiment has deteriorated. Trading just isn’t as fun when stocks aren’t going up6. The positive reinforcement cycle provided a tailwind to financial assets last year, the unwind is now a headwind as investors experience losses, lose interest, and head for the exits.

Structure

If the story of 2008 was the hidden risk of credit derivatives, the story of this cycle will be the hidden risk of equity derivatives.

Over the past several years, trading volume in options (and their derivative - volatility products) has exploded.

Every day we see the impact that options have on share prices. Because options dealers hedge their exposure by buying shares in the underlying stock, the option market indirectly also drives prices in the stock market. The most obvious example is a parabolic upward move in a stock driven by large out-of-the-money call volumes - often referred to as a “gamma squeeze”. The huge uptick in call volumes over the past several years has been a major driver of price appreciation at the single stock and index level.

Yet, there is a lurking danger that is largely ignored. While call options allow investors to make self-realizing upside bets, put options (and volatility) allow bettors to make self-realizing downside bets.

In other words, we have seen that if enough people buy calls with $50 strike, then a stock is sure to rise to $50. Similarly, if enough people were to buy S&P 500 puts at a 2,000 strike, the market would fall to there as well. Moves to the downside often are much faster, as we have seen in the COVID crash or “Volmageddon” in February 2018 (as explained below and detailed further in The Volatility Squeeze).

The rise of the option market makes for a more fragile market structure, capable of violent downturns. As sentiment falls, the Fed tightens, and economic headwinds grow, the likelihood of such a crash grows.

Policy

The final piece of the puzzle is simple. Don’t fight the Fed.

From February 2020 through March 2022, the Federal Reserve supported markets by holding interest rates at zero and flooding the market with $4.5 trillion of new liquidity through quantitative easing, more than doubling the size of its balance sheet in the process. The express purpose of these policies was to suppress interest rates, and boost asset prices.

Meanwhile, the federal government transfused much of these newly created funds directly into the checking accounts of individuals, businesses, and local governments. The $5 trillion of fiscal spending throughout 2020 and 2021 spurred spending, de-levered consumers, and drove record corporate profits.

Now, the Fed’s challenge is to rein in the highest inflation in decades, enabled by the incredibly accommodative monetary and fiscal policy of the past two years.

In March of this year, the Fed shut off the liquidity tap, and as of June it began to drain liquidity with quantitative tightening. At the same time, the Fed has hiked interest rates at the fastest pace in decades.

Just as the Fed sought to boost asset prices to support economic growth throughout the pandemic, reducing asset prices (or tightening “financial conditions”) is now a tool to fight inflation.

Conclusions

No one knows where the market is going with certainty, but I believe stocks will fall further. Wherever the path forward ends up leading, it will not be a straight line - it will be squiggly.

This is just one person’s analysis, to be taken alongside all the other information, opinions, and perspectives you can get your hands on. Chew on it, then spit or swallow.

What do YOU believe?

As reported monthly, from the peak in September 2000 (91.6) to March 2002 (40.1), per S&P Global.

Today, Amazon trades 127x LTM P/E.

Today, the market trades at 21.6x P/E or a 32.1x Shiller P/E implying a 4.6% or 3.1% earnings yield, respectively. Earnings yield is simply the inverse of the multiple (i.e. 1 / 21.6 = 4.6%).

Assuming a rate hike in September, the federal funds rate will be at its highest level since 2008.

In Irrational Exuberance, published in March 2000 at the very peak of the dot-com frenzy, Robert Shiller wonderfully describes the behavioral and social components of that speculative frenzy. While I had previously read the book, I only understood it academically until 2020. It did not prepare me for the real life experience.

Since mid-June there has been a relief rally across all assets, led by the speculative categories, bringing many off their lows. But perspective is key. Speculative bellwethers like Bitcoin and ARKK are still down 60- 70% off their highs.

I'm glad you put pen to paper. Uninspiring times call for squiggly lines. Appreciate what you do.

Another rational post in an irrational time. Thanks again TLBS.